40+ Will Filing Chapter 7 Affect My Spouse

6 to 30 characters long. Enter the result as a decimal rounded to at least three places.

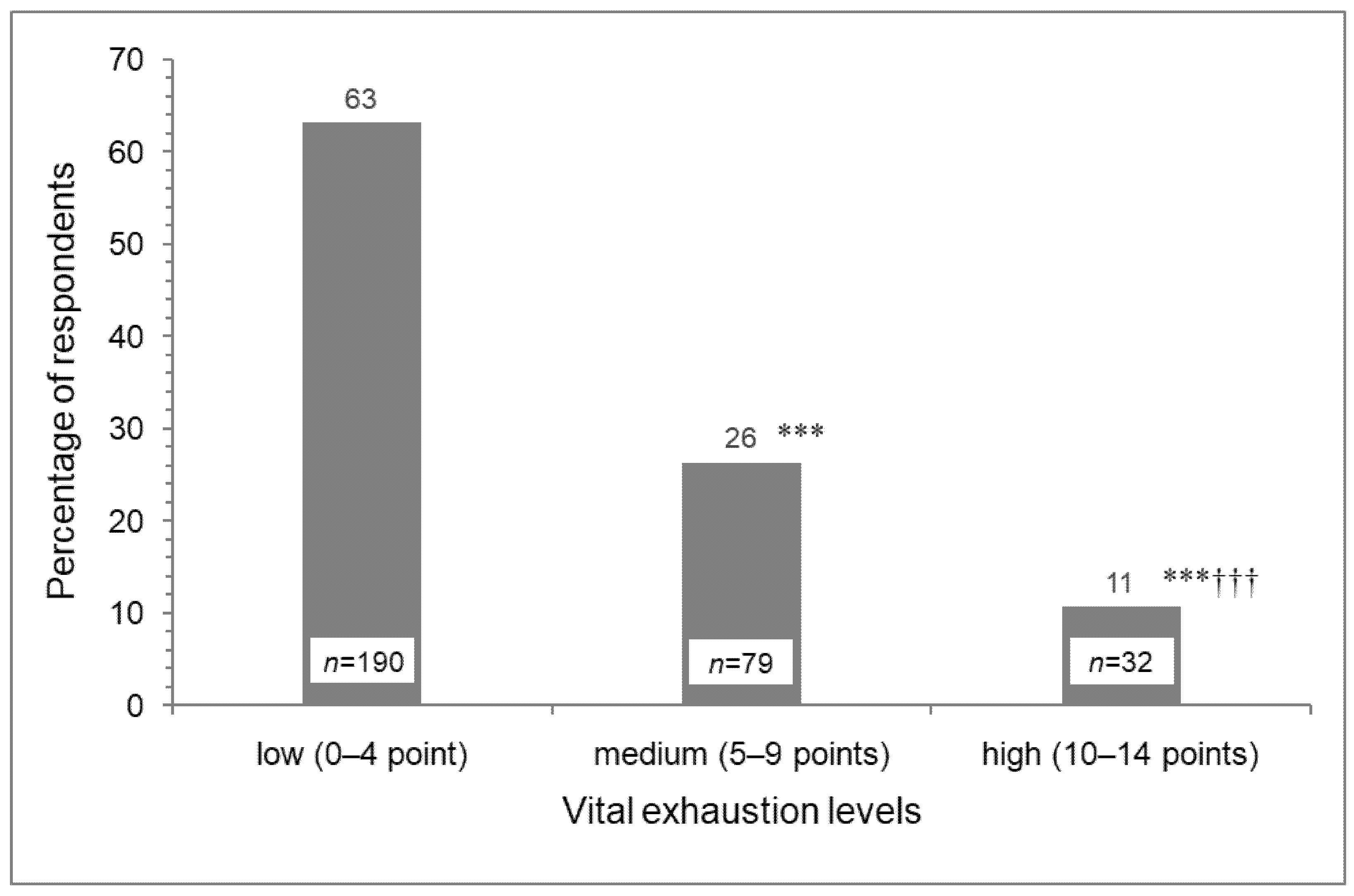

Ijerph Free Full Text Association Of Vital Exhaustion With Risk Factors For Cardiovascular Diseases Quality Of Life And Lifestyle In 41 44 Year Old Muscovite Men

Web The Code of Federal Regulations CFR is the official legal print publication containing the codification of the general and permanent rules published in the Federal Register by the departments and agencies of the Federal Government.

. Weekends 7 am-4 pm. Your spouse is considered to reach age 25 on the day before their 25th birthday. It is not an.

Web Publication 3 - Introductory Material Whats New Reminders Introduction. PT and weekends 7 am. File Form 1040 or 1040-SR by April 18 2022.

The income levels at which the AMT exemption begins to phase out have increased to 539900 1079800 if married filing jointly or qualifying surviving spouse. Web Under the special rule of Regulations section 202010-2a7ii executors of estates who are not required to file Form 706 under section 6018a but who are filing to elect portability of the DSUE amount to the surviving spouse are not required to report the value of certain property eligible for the marital deduction under section 2056 or. Chapter 13 protects personal assets such as a home which would be exposed to seizure if a sole proprietor filed Chapter 7.

Web If you and your spouse agree on the terms of a divorce then you may be able to get an uncontested divorce. NW IR-6526 Washington DC 20224. Web Find the latest US.

A business that lacks a viable future and is overwhelmed by obligations is a good candidate for a Chapter 7 business bankruptcy. Multiply line 5 by line 7. Must contain at least 4 different symbols.

Web If you and your spouse agree on the terms of a divorce then you may be able to get an uncontested divorce. A quick divorce can save money on May 25 2022 4 min read. Web For further information including the timeframes regarding filing claims or amended returns see Revenue Ruling 2013-17.

Web Breaking News data opinions in business sports entertainment travel lifestyle plus much more. Divide line 3 by line 6. Enter the result here and on lines 13 and 17 of Form 8606.

For 2021 the amount of your education savings bond interest exclusion is gradually reduced phased out if your MAGI is between 83200 and 98200 124800 and 154800 if you file a joint return. In most states these are faster and May 02 2022 4 min read. Web Death of spouse.

Call sales See our FAQs Resources Divorce Divorce. Read breaking headlines covering politics economics pop culture and more. 2022 was an incredible year for handheld gaming.

Web Filing for divorce is never pleasant but if you have the right assistance or know-how youll be prepared to start your divorce. Web Get help navigating a divorce from beginning to end with advice on how to file a guide to the forms you might need and more. Web 744104 Verification of documents.

Web Why not file Chapter 7 liquidation bankruptcy and be done with it. 59050 if married filing separately. Education savings bond program.

If the result is 1000 or more enter 1000. Web The companies stated their case for why Microsoft should be allowed to buy Activision for 687 billion. Taxable portion of the distribution before adjustment.

ASCII characters only characters found on a standard US keyboard. Web CREATE A FOLLOWING Tribune Content Agency builds audience Our content engages millions of readers in 75 countries every day. Web Mon-Fri 5 am-7 pm.

We welcome your comments about this publication and your suggestions for future editions. You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. Web Filing a divorce in New Hampshire has specific residency requirements.

Knowing what to do Nov 11 2022 5 min read. Revenue Ruling 2013-17 PDF along with updated Frequently Asked Questions for same-sex couples and updated FAQs for registered domestic partners and individuals in civil unions are available today on IRSgov. Due date of return.

Web Comments and suggestions. The business mileage rate for 2022 is 585 cents per mile. If you are filing a joint return with your spouse who died in 2022 you meet the age test if you are at least age 25 but under age 65 at the end of 2022 or your spouse was at least age 25 but under age 65 at the time of death.

The Electronic Code of Federal Regulations eCFR is a continuously updated online version of the CFR. Nontaxable portion of the distribution. Under penalties of perjury I declare that I have read the foregoing and the facts alleged are true to the best of my knowledge and belief Any person who shall willfully.

Find out about divorce procedures and laws including no-fault grounds for May 02 2022 6 min read. You may use this rate to reimburse an employee for business use of a personal vehicle and under certain conditions you may use the rate under the cents-per-mile rule to value the personal use of a vehicle you provide to an employee. The due date is April 18 instead of April 15 because of the Emancipation Day holiday in the District of Columbiaeven if you dont live in the District of Columbia.

In most states these are faster and May 02 2022 4 min read. Were available Mon-Fri 5 am. Knowing what to do Nov 11 2022 5 min read.

Web Filing for divorce is never pleasant but if you have the right assistance or know-how youll be prepared to start your divorce. Web By filing a no-fault uncontested divorce with an agreement an attorney has reviewed you can get a quick divorce. Get help navigating a divorce from beginning to end with advice on how to file a guide to the forms you might need and more.

Web We removed former chapter 6 and renumbered chapters 7 through 13 for this revision. Web The AMT exemption amount is increased to 75900 118100 if married filing jointly or qualifying surviving spouse. When verification of a document is required in this chapter or by rule the document filed shall include an oath or affirmation or the following statement.

Goodtherapy What Is The Right Thing To Do When An Old Lover Connects With You Online

6 Ways To Respond To Your Husband S Toxic Ex Wife She Blossoms

How Will Claiming Bankruptcy Affect My Spouse

Pdf Reliable And Valid Coding Of Thin Slices Of Video Footage Applicability To The Assessment Of Mother Child Interactions

Filing For Bankruptcy Without Your Spouse

Cutting Ties With Toxic Family Members An Act Of Self Care Live Well With Sharon Martin

Will Filing For Chapter 7 Bankruptcy Affect My Spouse

Xclaim Blog 101 What Is Bankruptcy Claims Trading

![]()

Does Filing Bankruptcy Affect Your Spouse Can You File By Yourself

What Happens If My Spouse Files For Bankruptcy Sands Associates

Grotthuss Molecular Dynamics Simulations For Modeling Proton Hopping In Electrosprayed Water Droplets Journal Of Chemical Theory And Computation

Leaving A Sexless Marriage The Forgiven Wife

Will A Bankruptcy Affect My Spouse S Credit Tampa Debt Relief Lawyers

Will Bankruptcy Affect My Spouse S Debts And Credit National Bankruptcy Forum

The Immortals Gunn James Amazon De Bucher

Blog Ideas To Inform Your Data Strategy Fivetran

Legal Effects When Only One Spouse Files For Bankruptcy Legalmatch